Every day data security becomes a more serious concern to both merchants and consumers. To fight the epidemic of fraud First Data Independent Sales (FDIS) works to make sure its systems and processes are secure as well as helping our merchants comply with industry requirements.

FDIS notifies all of our customers that have a merchant account in several ways to help them with data security and becoming Payment Card Industry (PCI) compliant such as:

- Messages in merchant account statements

- Mailings and emails

- Telephone calls

- Notifications and links on websites

We also take a multi-pronged approach to secure the sensitive data we handle through:

- Always staying PCI compliant.

- Using tools such as antivirus, anti-spam applications, firewalls, filtering, intrusion detection, encryption, event monitoring, file integrity monitoring, vulnerability scanning and strong authentication.

- Scheduled external and internal vulnerability scans.

- Demanding all new employees to undergo pre-employment screening, which includes national background checks and drug tests. In addition, all employees undergo annual training on privacy and data security policies.

Merchants can protect their business by:

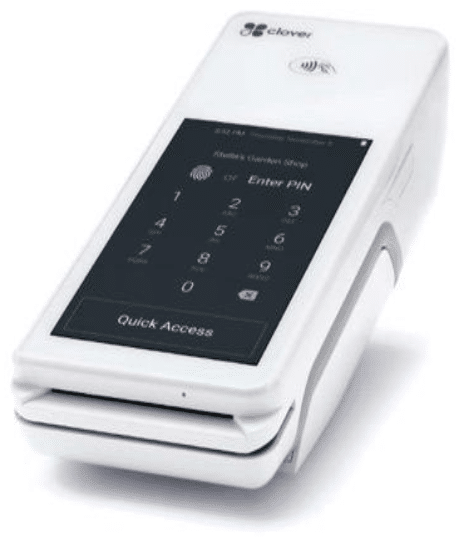

- Ensuring that the credit card machines they use are PCI certified.

- Not storing unencrypted credit, debit card numbers, CVV or CVV2 numbers.

- Validate PCI compliance at least yearly.

- Doing quarterly network security scans. Merchants are required to perform scans if they have an external-facing Internet protocol address that collects, processes or transmits payment account information.

Recent Comments