Payment for goods and services has come a long way, and has made many transitions throughout history. What was once a valid form of payment may not be so valid today. In this electronic and digital age it is all about convenience and simplicity for the customers, which requires the use of merchant account services and credit card processing.

One thing is for sure. There has been a paradigm shift over the last two decades that has all but eliminated the need to carry a checkbook or cash. More and more people have turned to the use of debit and credit cards as a convenient, safe and secure method of payment. Businesses who still refuse to accept credit cards are not serving their customers as well as they could.

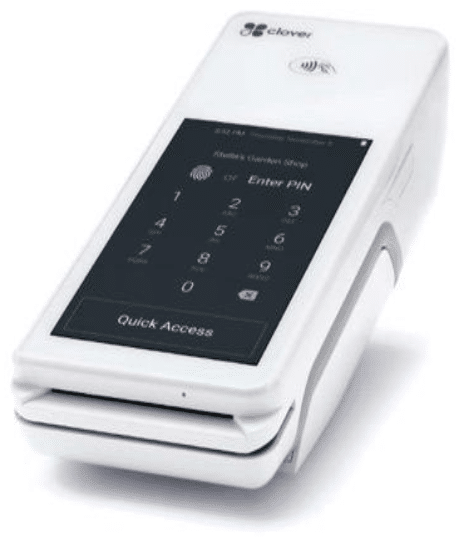

Not only does credit card acceptance benefit the customer, it assures the merchant that they will receive payment. Thanks to the state-of-the-art credit card machines in use, merchants know that the funds have been secured before the customer walks out of the store with the goods or services they came in for.

Merchant processing makes it possible for a business to accept credit card payments by way of a system linking up four components: merchants, issuing banks (the cardholder’s bank), acquiring banks (merchant’s bank) and the cardholders themselves. A consumer wishing to purchase a product or service submits his or her credit card to the merchant. The cardholder’s bank authorizes the transaction using the processing network, then the acquiring bank pays the merchant the amount of the transaction minus any fees.

Businesses who accept credit cards have lower administrative costs. It also increases revenue and secures payment much quicker. Even more importantly, the relationship with the customers is increased for the better, as it makes patronizing the business much more convenient for them.

Recent Comments