Imagine this scenario: You’re in a curio shop in Cabo San Lucas, when a brightly colored serape strikes your fancy. After you give the clerk your credit card, he disappears into a back room for about a minute. He returns and hands you back your card and your bagged purchase. You think nothing about that until over one-thousand-dollars in online purchases appear on your next credit card statement. Purchases you didn’t make.

You’ve been a victim of one of the easiest forms of credit card fraud. The curio shop clerk had written down your credit card number, along with your name, expiration date and the security code on the back. That’s all the person to whom he sold that information needed to ring up purchases all over the internet.

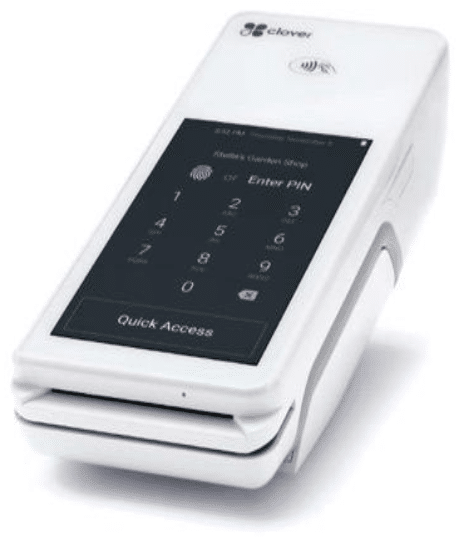

Avoid credit card fraud scams by keeping your eye on your credit card during transactions and by dealing with merchants who offer quality credit card processing. Don’t let fraudulent card usage ruin your day.

The moment you get your credit card statement, open it and read it carefully. Look for not only major charges, but several smaller ones that might otherwise go unnoticed. Keeping a close eye on your credit card account helps avoid credit card fraud and helps to safeguard your credit as well.

Besides your computer, the best piece of equipment you can have in your office is a shredder. Frequent use of your shredder will help protect you by getting rid of unneeded credit card receipts. It’s not terribly sophisticated, but going through your trash left by the curb is another way sneaky scammers can pilfer your personal and credit card information.

Your signature is uniquely yours. Make use of it the moment you receive a new credit card by signing the back of it. It’s just another step to protect yourself and help avoid credit card fraud.

One of the most oft-used scams is sending unsolicited e-mails requesting information about you, including your credit card number(s). Some of these will even have your bank’s logo on them. A reputable company would never request such information by e-mail.

The same applies to unsolicited phone callers who request your personal and credit card information.

Another thing you can do to protect yourself is to photocopy each credit card you’ve received, or at least write down its number and the issuing institution. Call and cancel all lost credit cards immediately.

When making a purchase online or otherwise using your credit card number, always make sure you’re on a secure site. With today’s technology, unsecure sites are easy pickings for scammers specializing in fraudulent credit card usage. Your most effective weapon to avoid credit card fraud is common sense. Guard your credit cards by keeping your personal information … well … personal.

Follow these suggestions to protect your credit cards, your credit and your peace of mind.

Recent Comments