Credit card processing allows merchants to accept and receive payments with customer credit and debit cards. Typically, the process involves signing a contract with a merchant account provider that specializes in processing credit cards. The company then deposits funds from credit card sales into the checking or saving accounts of merchants.

Importance

More than a third of all households in the U.S. use at least one form of credit or debit card on a regular basis. Consumers are more willing to shop on store sites that accept credit cards than on those that do not. This accounts for the increasing need by businesses to accept credit cards as a means of making payments.

Function

Through the processing of credit cards, businesses have the authority, and are able to determine if a credit or debit card has adequate funds to process a sale. The records for all credit card purchases made during a day are saved in an electronic file. The file is sent to the processing company at the end of the day. The credit card processor then sends this information to the credit card issuing companies so that their customers can be billed and the merchant receives their money.

Equipment

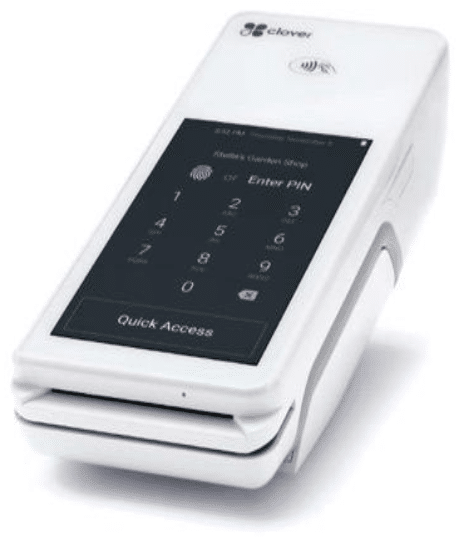

The most basic equipment for credit card processing is a standard terminal connected to a card reader where the cards are swiped. The terminal has keys used for entering information about a purchase. The information is sent over the terminal through a data or phone cable. A receipt is printed once an approval is received. The customer signs the receipt either through the terminal or on another printer.

Cost

There are a number of factors that determine the cost of processing credit cards. These factors include whether the credit card information is keyed in or swiped, the type of card used and average dollar amount of business transactions. Most credit card processors charge a fee of less than a dollar on top of an additional 1-7 percent of the purchase price for each transaction. The transaction fee is sent directly to the credit card company for the use of the card. Other fees such as batch, compliance, set-up, supplies, and statement fees may be applied.

Variations

Certain merchants prefer computer card processing instead of the more common terminal card processing. The computer systems can be linked to credit card processors or online payment services.

Recent Comments