Have you ever found yourself wondering how a credit card transaction is processed? The credit card payment process that occurs when a consumer makes a purchase with a credit card (whether at a brick-and-mortar retail store or online), involves 5 separate entities. Each has a role to play in the secure transfer of funds from the consumer’s financial account to the merchant’s.

The 5 Entities that Work Together to Accomplish the Secure Transfer of Funds:

1. The Cardholder: This refers to the individual who uses their credit card to make a purchase.

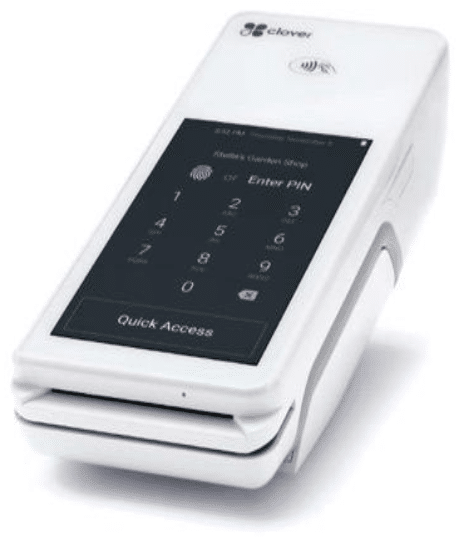

2. The Merchant: This refers to the store or retail outlet where the credit card purchase is made.

3. The Merchant’s Bank: A merchant account services provider is responsible for the secure transfer of credit card information from consumer account to merchant bank account.

4. The Card Network: Card networks (such as Visa and MasterCard) play an important role in transmitting information between all parties involved in a transaction. Banks issue credit cards under the brand of a certain card network.

5. The Issuing Bank: This is the bank that issued the cardholder’s credit card.

The transaction process works like this:

First, the cardholder presents the card to the merchant. The merchant processes the purchase request and sends it to their bank. Merchants use a payment gateway that provides them with merchant account services. Once the payment gateway has completed the transfer of information, the merchant’s bank sends the authorization request to the card network. The network then finds the institution that issued the credit card and forwards the request to them. The issuing bank (of the consumer’s credit card) checks to ensure that there is enough credit available and then sends approval/denial back to the card network. The data then flows in the reverse order, from the card network to the merchant’s bank and finally to the merchant.

This credit card payment process is required for each transaction. In addition, each merchant needs to settle its transactions at the end of the day with its bank. The merchant’s bank, which provides them with merchant account services, sends the transactions to the different networks. It is important to note that the networks charge a fee for each transaction before forwarding the transaction records to each issuer. The card issuer (which is the bank that issued the customer’s credit card) charges a fee and forwards the records to the merchant’s bank. Then the merchant’s bank charges a fee and pays the merchant for all transactions that were completed during the day. Finally, it is the issuing bank that adds the purchase onto the customer’s credit card statement and collects the funds from the customer.

With the technology that is available today, the entire process takes only a couple of seconds to complete. All information is sent via an encrypted and secure connection to prevent it from being intercepted by an unauthorized party along the route. Experienced businesses know exactly how important it is to utilize the specialized knowledge and tools of merchant account services in order to provide convenience and security to all customers.

Recent Comments