Merchant Account v Gateway: What’s the Difference?

In the world of commerce, accepting credit cards is vital to the financial health of the business, whether it is a brick-and-mortar business or an Internet-based endeavor. To accept credit cards, a merchant must have at least a merchant account. If transactions are via the Internet, an additional tool called a gateway must be utilized to effect proper payment processing. Although often combined, the merchant pays separate fees that differ according to the tool sponsors or issuing agency. How do these tools relate to facilitate smooth and fast transactions for consumers?

Merchant Accounts

The account itself is the commercial bank account into which credit or debit card payments are deposited. Very few allow bill or payroll payments but can allow transfers into standard business accounts.

Most merchant accounts require a term contract. Some organizations, most often banks, require a 6-month term for online businesses and a 1 or 2-year contract term for brick-and-mortar merchants. After the contract term for credit processing services expires, the account defaults to a month-to-month arrangement.

Although any merchant can apply for a merchant account at the start of business operations, most experts advise e-commerce operations wait until they regularly have at least $1,000 in monthly revenue to easily afford monthly and transaction fees.

Fees often associated with these accounts include a monthly service fee and a percentage of each transaction. The average transaction fee for credit card processing services is roughly 1.75 percent, but amounts may vary greatly from service provider to provider.

Gateway Use

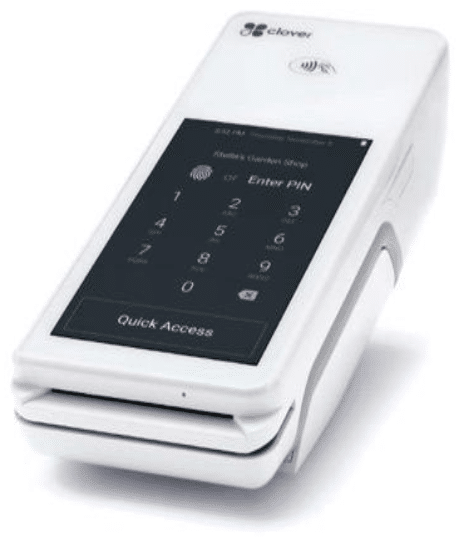

A gateway is the tool used to connect the merchant with the merchant account processing service that authorizes credit card payments. It is a virtual or electronic terminal equivalent to the card swipe machines many brick-and-mortar stores currently use.

Gateways can be integrated into a website’s cart program, or it can entail a separate procedure of keying in the credit card information.

Businesses need not be based on the Internet to leverage gateways. Special card-swipe connections to the cash register can access a ‘real life’ register to this processing service for immediate credit into a merchant’s account.

Summary

In today’s retail environment, credit card payments are the rule, not the exception. Whether a business operates online, offline or in a combination of retail scenarios, profit margins are often dictated by offering credit or debit card payment options. Cash may be king, but credit is emperor of the retail world.

Recent Comments